29+ Debt payments to income ratio

The actual loan payment amounts may vary. If your DTI becomes a concern you.

Balance Sheet Templates 15 Free Docs Xlsx Pdf Balance Sheet Template Balance Sheet Personal Financial Statement

To calculate his DTI add up his monthly debt and mortgage payments and divide it by his gross monthly income to get 032.

. Finally divide your total monthly debt payments by your monthly income to find out your DTI. When considering loan risks all lenders must consider this. To calculate it simply add up all of your debt.

The maximum debt to income ratio borrowers can have is 50 on conventional loans. Add up your monthly bills which may include. To calculate your debt-to-income ratio add up your recurring monthly debt obligations such as your minimum credit card payments student loan payments car.

When you divide the monthly payments by the gross monthly income the result you get will be a decimal. When it comes to DTI the lower the ratio the better Ulzheimer says. It means you can take on new debt more easily because you have the capacity to make the payments he.

Your debt-to-income DTI ratio and credit history are two important financial health factors lenders consider when determining if they will lend you money. The debt-to-income ratio will be displayed as a percentage. Student auto and other monthly loan payments.

For example if your monthly income is 3000 and you have a car payment of 300 your. Example Total Monthly Debt Payments Rent or Mortgage Payments Minimum. Heres an example.

Debt to income ratio is the percentage of your monthly income that goes towards paying your debts. For example lets say you pay 1000 for your mortgage 500 for your car and. Monthly alimony or child support payments.

Called DTI for short your debt-to-income ratio is the percentage of your gross monthly income that goes toward debt payments. Monthly rent or house payment. Debt-to-income ratio for a USDA loan.

A borrower with rent of 1200 a car payment of 300 a minimum credit card payment of 200 and a gross monthly income of 6000 has a debt-to. Debt-to-Income Ratio Use this calculator to quickly determine your debt-to-income ratio. To calculate your DTI ratio divide your total monthly debt payments by your gross monthly income.

Multiply that by 100 to get a percentage. Then multiply the result by 100 to come up with a percent. The debt-to-income ratio DTI compares your monthly debt payments to your monthly income.

To calculate your estimated. This is the percentage of your gross income required to cover your housing and debt payments. To qualify for a USDA loan your backend DTI should be 41 or less with no more than 29 of your income going toward your future.

Back-end ratios are the same thing as debt-to-income ratio meaning they include all debt related to mortgage payment plus ongoing monthly debts such as credit cards auto. To calculate the ratio divide your monthly debt payments by your monthly income. Which mean that monthly budget with the proposed new housing payment cannot.

Example In our example Sams. Your debt-to-income DTI ratio and credit history are two important financial health factors lenders consider when determining if they will lend you.

Is Long Term Investing Always Safe Quora

What Are Penny Stocks In Indian Market Which Has Great Potential In Future Quora

Income Statement Template Excel Income Statement Statement Template Excel Spreadsheets Templates

Pay Stub Maker Online Free Paystub Maker Tool For Your Stubs Stubcreator Payroll Template Templates Good Credit

18 Free Simple Budget Templates Word Excel Pdf Formats

Net Worth March 2022 The Money Commando

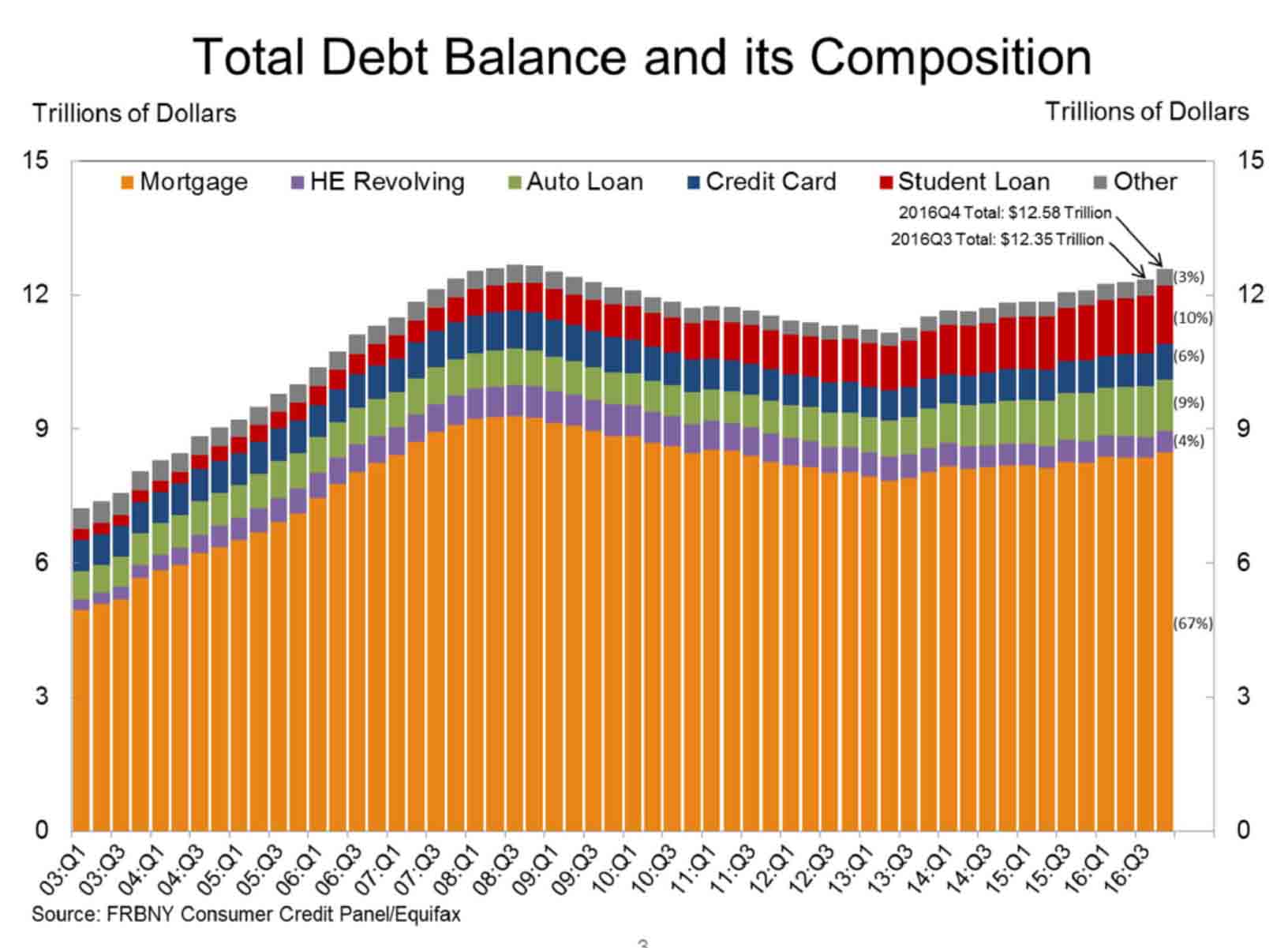

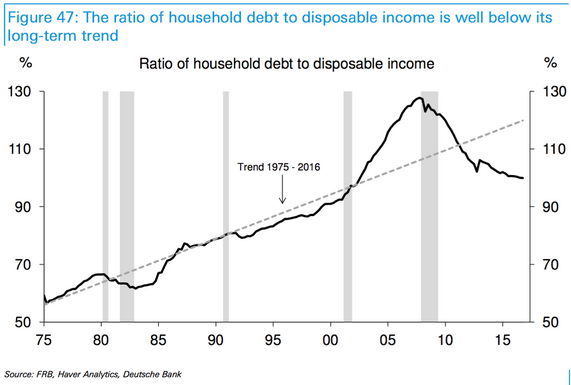

The World As We Knew It Is Gone What We Can Do About The Decline Of The Middle Class Seeking Alpha

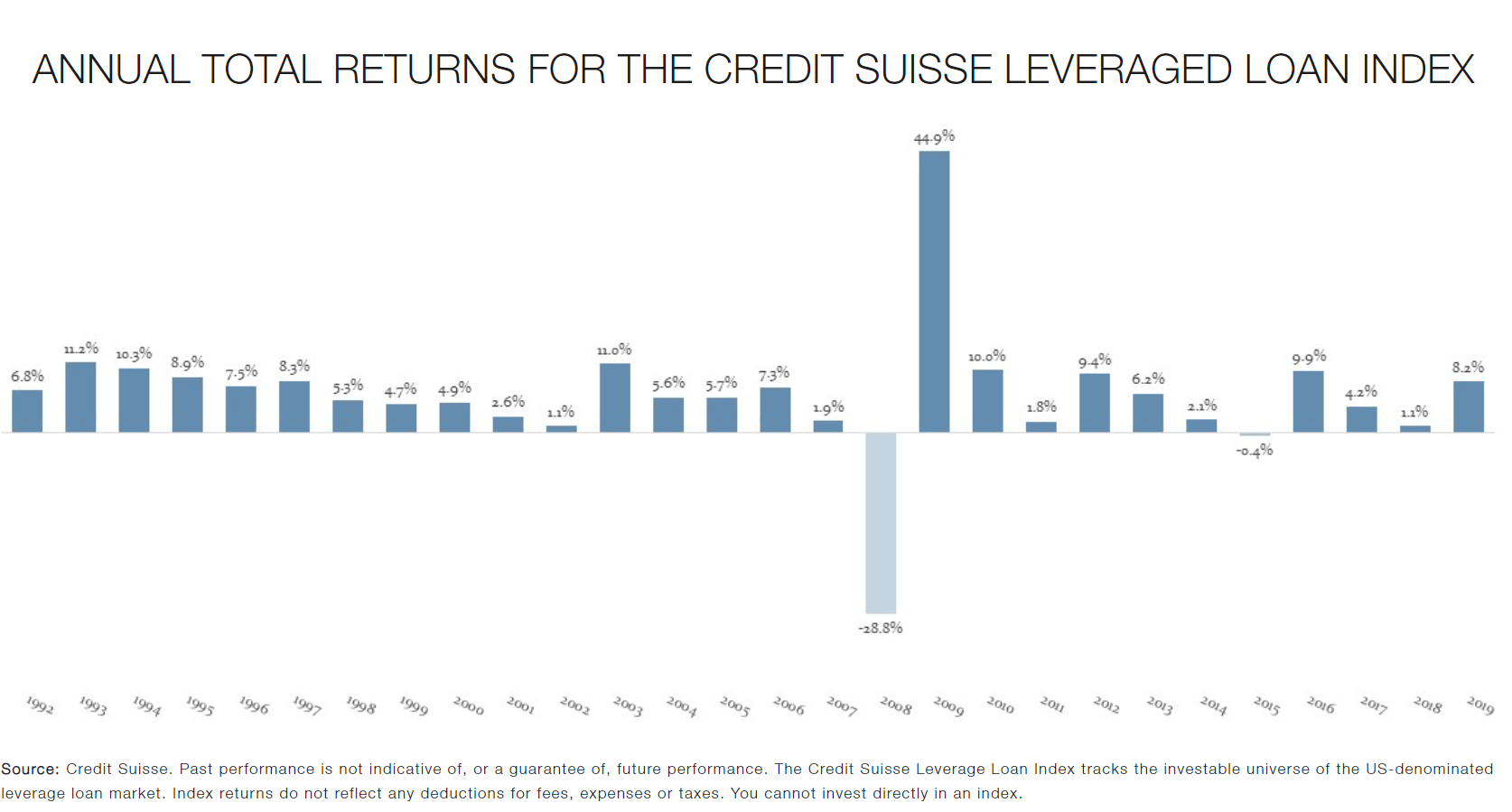

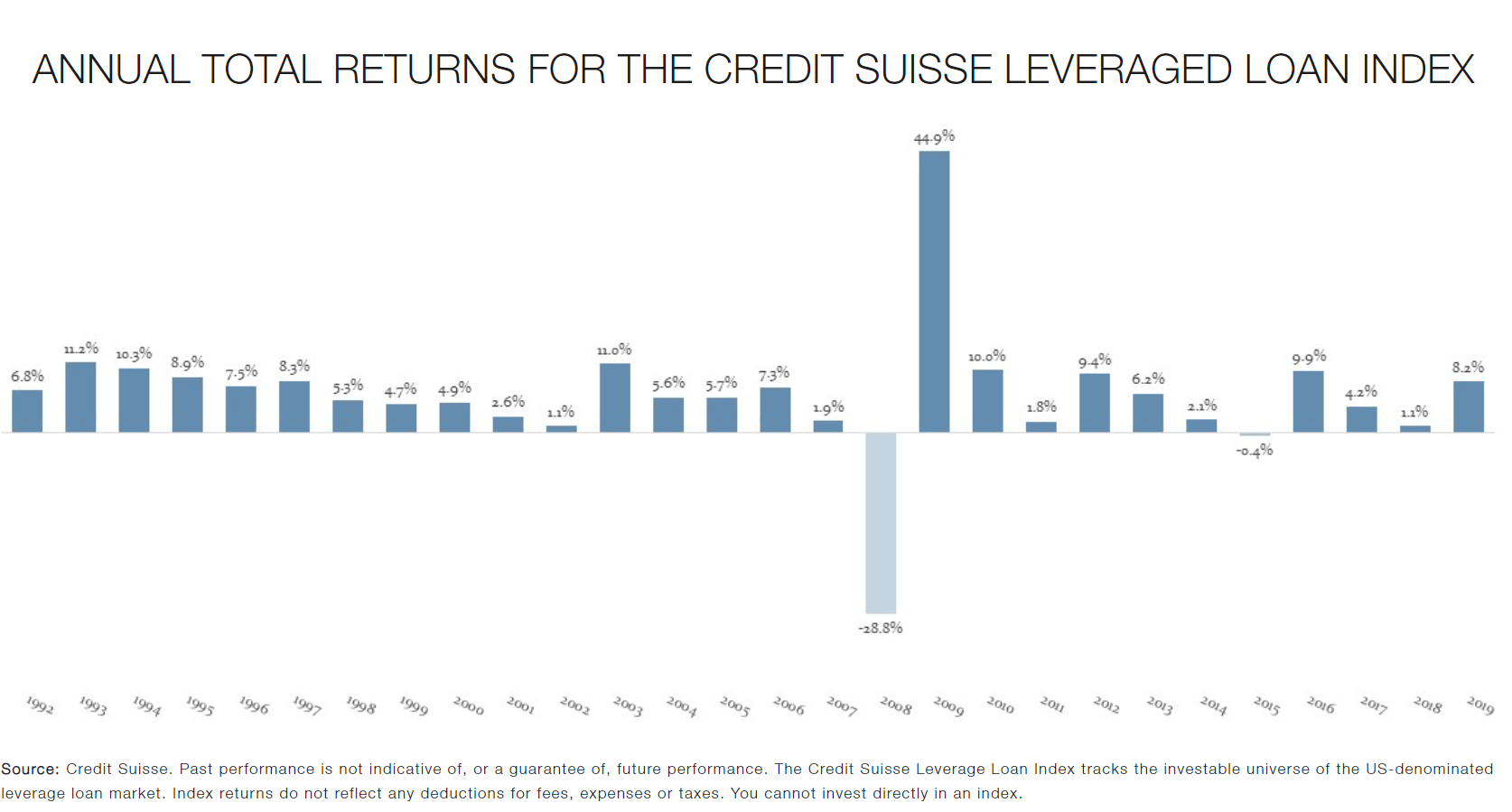

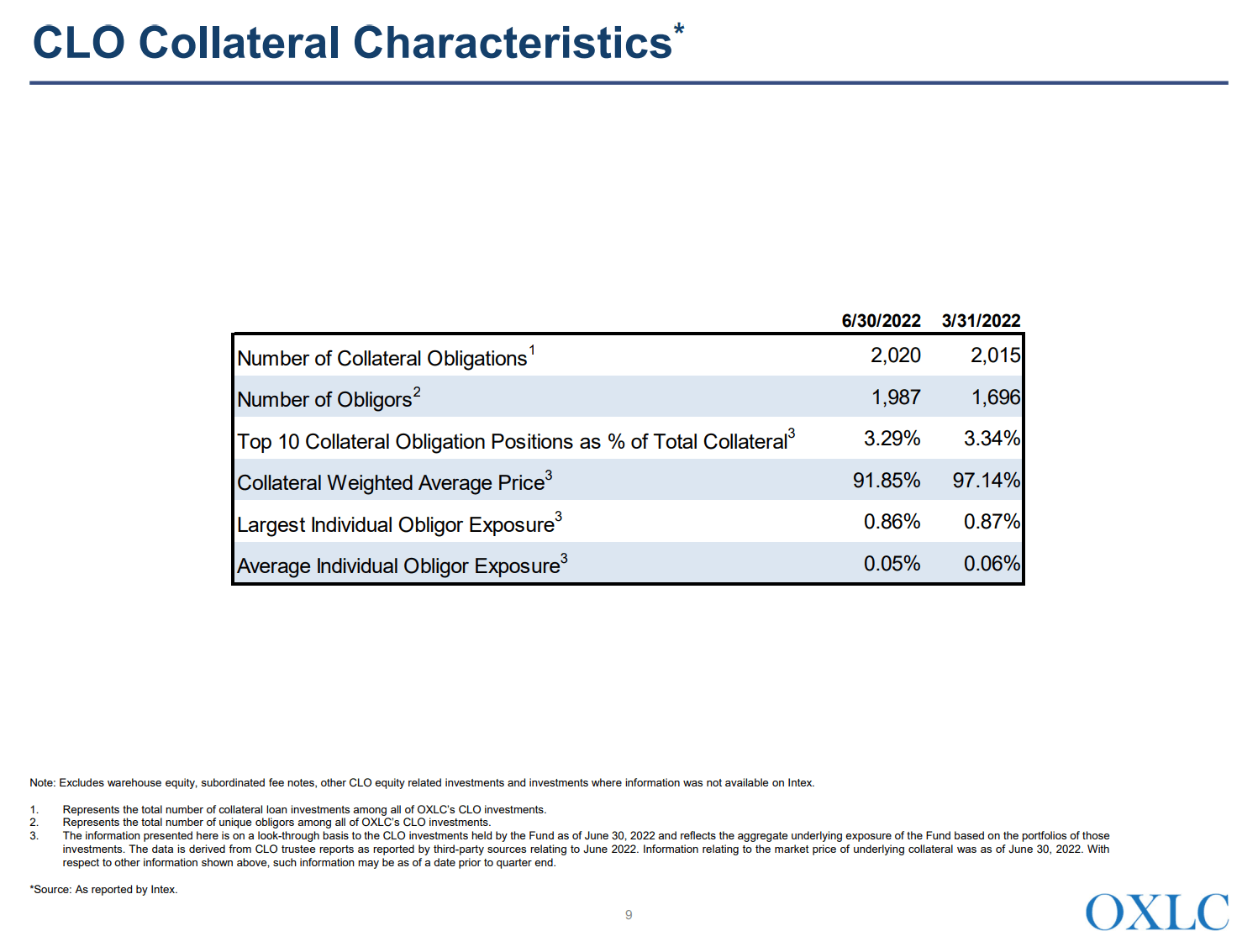

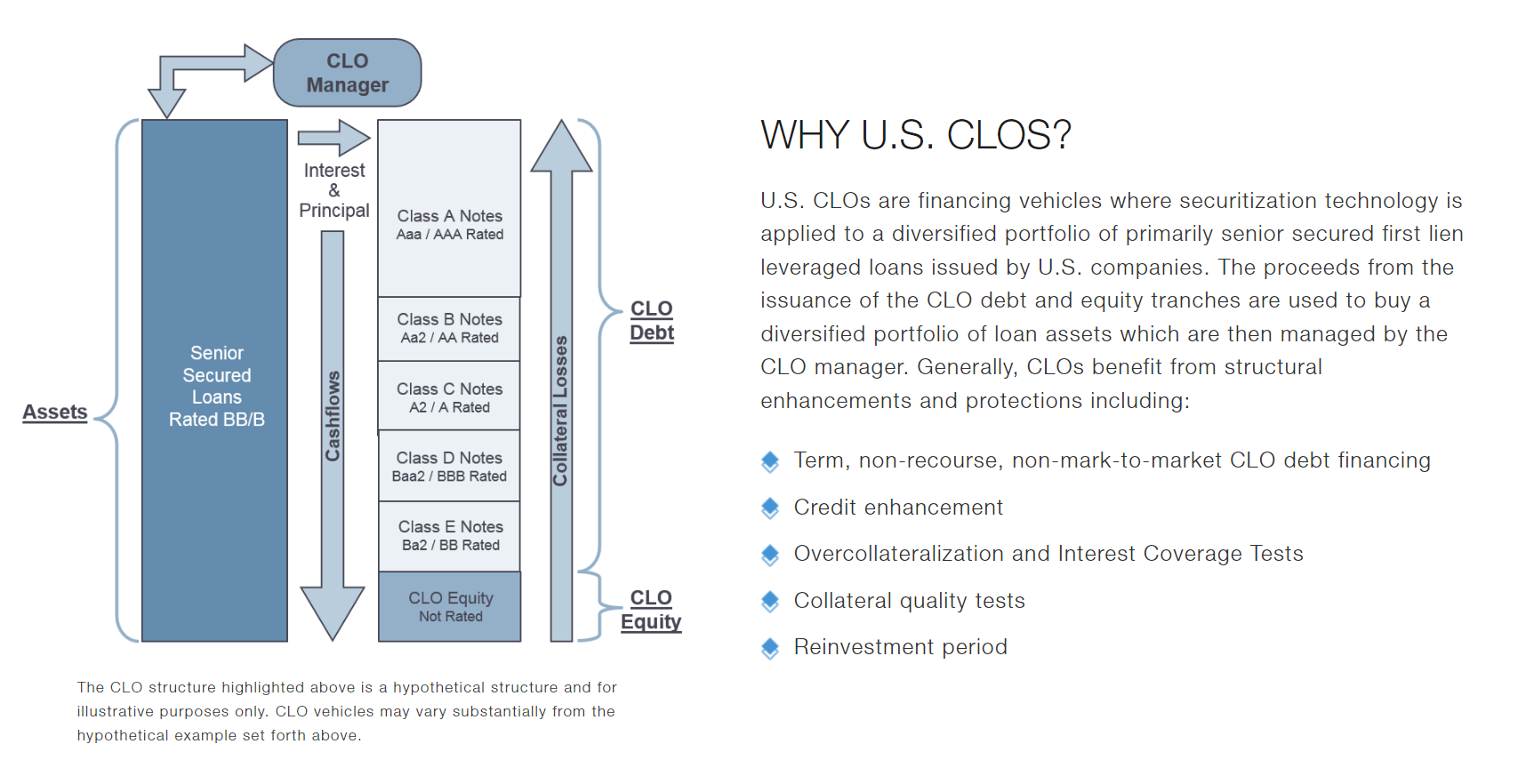

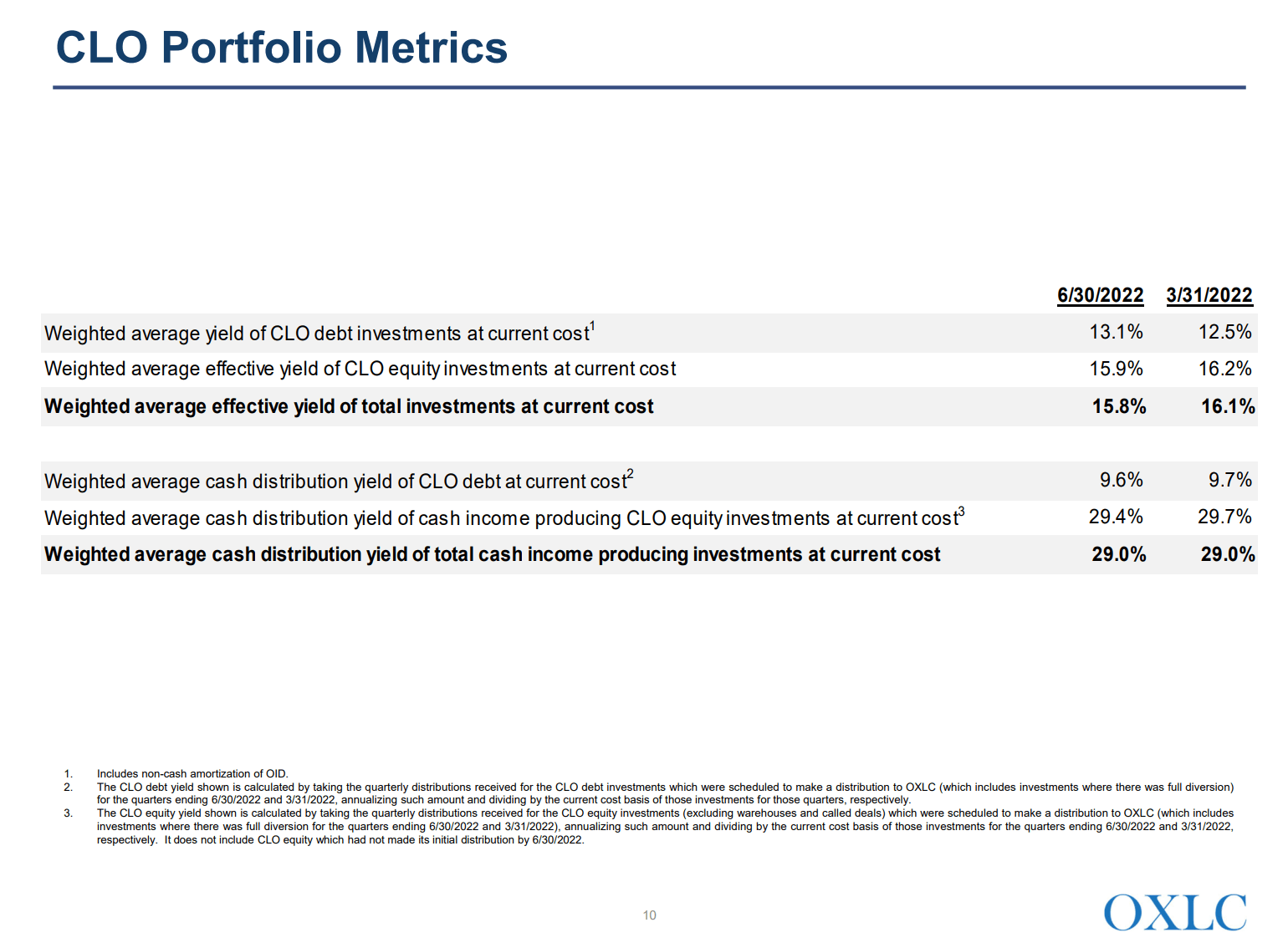

Oxford Lane Capital Stock Look Beyond The Yield Nasdaq Oxlc Seeking Alpha

Oxford Lane Capital Stock Look Beyond The Yield Nasdaq Oxlc Seeking Alpha

How Do We Know The Amount Of Debt A Company Has In Indian Stock Market Quora

The World As We Knew It Is Gone What We Can Do About The Decline Of The Middle Class Seeking Alpha

Oneok Strong Performance A New Era For Dividends Nyse Oke Seeking Alpha

Drs

Oxford Lane Capital Stock Look Beyond The Yield Nasdaq Oxlc Seeking Alpha

Oxford Lane Capital Stock Look Beyond The Yield Nasdaq Oxlc Seeking Alpha

Oxford Lane Capital Stock Look Beyond The Yield Nasdaq Oxlc Seeking Alpha

Understanding Bond Prices And Yields Fixed Income